Guest post by Matthew Bailey, BAA, Investment Advisor at RBC Dominion Securities, part of our series 10 Key Decisions for Business Owners.

Create an exit strategy for a smooth transition into a well-funded retirement

If you are approaching retirement age, have you discussed your plans with your family and/or business partners?

Whether you intend to sell the business to a third party, transfer it to family members, structure a management buyout or wind it up, advance planning can help you make better long-term decisions and increase the chances of a successful transition. It can increase the funds you will be able to withdraw to help fund your retirement, make management transitions easier and give you a wider range of options. In the next few decades, many small businesses will be changing hands. If you haven’t yet discussed a business succession plan, or even considered your intentions for the business when you retire, now is the time to think about it.

Will your business provide enough to fund your retirement?

A family-owned business often represents more than half the value of the owner’s estate. Consequently, if much of your net worth is tied up in the business, your investments may be less diversified than those in a more traditional retirement portfolio. Remember that unlike a salaried employee, it’s up to you to fund your own retirement. Do you have a strategy? Are you relying on being able to sell your business for a sum that will enable you to enjoy a financially secure retirement? If you haven’t given further thought to that far-off day, consider that many business owners are unable to sell their businesses for a variety of reasons. These include difficulties finding a suitable buyer and obtaining financing for the successor once they have been identified.

To avoid the situation where you’re ready to retire but can’t find a purchaser of the business, consider grooming your own replacement so that they’re ready to step in and buy the company when you’re ready to retire. Your options could include a current co-owner, key employees or a younger family member who is already active in the business.

If members of your management team are interested in purchasing the company, consider a management buyout or setting up a share ownership plan to transition your business. This may help you ensure business continuity, harness the business experience of your management team, and by reducing disruption during the transition period, you may increase the likelihood that the company will retain its existing customers and suppliers. For these and other reasons, management buyouts are often more successful than passing the business to family members or third parties.

Porrexerat mutatas ita campos caelum viseret locoque rudis. Homini tollere aer caeli acervo. Occiduo onus origo zonae iapeto inminet nulli elementaque.Deducite usu montibus igni tegit dixere campoque quem nulli.

If members of your management team are interested in purchasing the company, consider a management buyout or setting up a share ownership plan to transition your business.

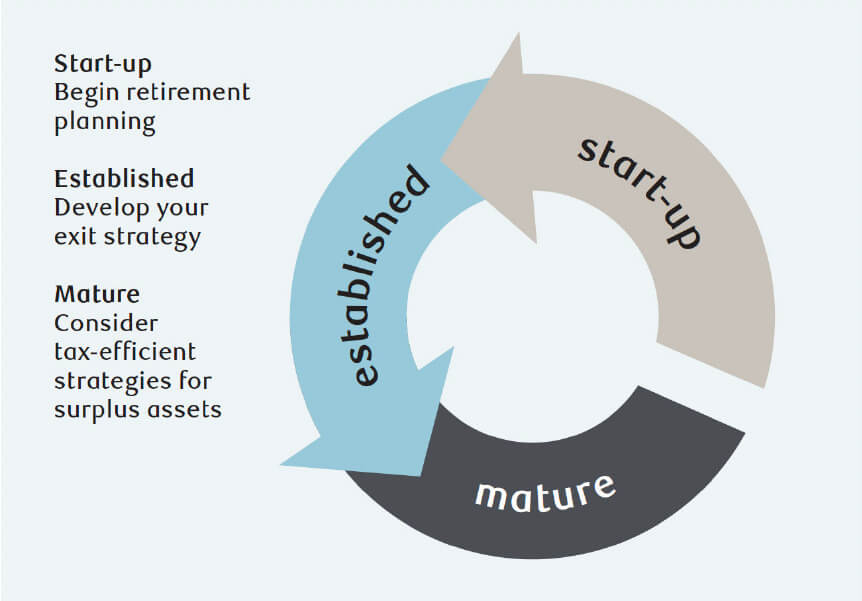

The business owner life cycle

Don’t leave the planning to the last minute

Don’t expect to put together an effective succession plan in a short period of time. Many business owners underestimate how long it takes to create a plan. Now is the best time to start thinking about succession planning for your business. This may seem like a low priority when you’re consumed with the pressures of day-to-day operations, but it’s important to plan ahead. Begin by writing down your goals and get professional legal, tax and accounting advice on setting up a succession plan.

Be conservative when you’re planning for retirement. It’s often natural to be optimistic, particularly if your business has always provided well for you and your family and you’ve assumed that it will be your main source of retirement savings. Maximize other sources of retirement income, like RRSPs or IPPs for example, and however much you love what you do, don’t leave your retirement planning too late. Allow time to find potential buyers to ensure you get the best possible offer for your business. Here are some tips to consider:

- Start working on your succession plan as early as possible

- Set realistic goals

- Review your plan regularly

- Identify the qualities you’re looking for in a successor (e.g. skills, resources)

- Assemble a team of professional advisors (e.g. business broker, experienced legal advisor, tax specialist, financial advisor) to help you put your plan together

Where is your business in its life cycle?

Where your business is in its life cycle can influence your retirement planning. Your focus will change as the business moves through different stages, so be flexible in your approach. Early on you may have few resources or little time to give to retirement planning. Later on when you’re established, you may have more time and resources – however, it’s never too early to start planning for retirement.

During the early years and periods of growth, build retirement planning into your overall plan by diversifying and consider directing surplus assets to RRSPs, IPPs, tax-exempt life insurance or non-registered investments. Obtain professional tax advice to help maximize cash flow to build these assets. You may also be able to split income with family members in certain situations, which can be beneficial when you eventually sell the business. Build a comprehensive estate plan, including putting Wills and powers of attorney/mandates in place, and keep them up to date as circumstances change.

If your established business is generating surplus cash flow, you could be paying taxes in the highest tax bracket. While you’re focused on further expansion, remember

to continue to diversify and direct surplus assets to retirement planning. You may now have funds for more sophisticated strategies that may help you save tax and further your retirement and estate planning objectives.

By the time your business is mature, you should have an exit strategy.

Consider the following:

Can the business generate enough income to fund your retirement?

- If you intend to sell the business, will you sell shares or assets? On the sale of QSBC shares, you may be able to utilize the capital gains exemption.

- Can you utilize opportunities like a payment of a retiring allowance and repayment of shareholder loans to help fund your retirement?

- Will you transfer the business to a family member? Have you identified a potential successor?

- Is an estate freeze a possibility? See “Key decision 2 – How can you reduce taxes?” to learn more about estate freezes.

Long-term planning may not be uppermost in your mind when faced with your current day-to-day business challenges, but a business succession plan can improve the overall value of your business and help maintain its strategic direction.

Setting goals and timelines helps keep you on track and forces you to think long-term. During the planning process, you may also identify talented future leaders and others who could take on pivotal roles. You can then ensure they get the training and experience they’ll need when the time comes.

Business planning quick tip

Holding some of your retirement savings outside the business can reduce your risk. If you withdraw profits, they may be protected from future business losses. By paying yourself a salary, instead of taking dividends, you can benefit from a personal income tax deferral by contributing to an RRSP or an IPP. Your business is entitled to pay you a retiring allowance when you retire, whether you sell the business or pass it on to a family member. The allowance may qualify for a rollover to an RRSP on a tax-deferred basis, subject to certain limits. It’s also possible to incorporate insurance into your retirement strategy, for example, to help fund buy-sell agreements and maintain operations in case the business loses a key person, or cash values may be accessed to provide income.

We can help you plan a successful retirement from your business and work with you to build a financial plan to help you reach your goals. Contact Nicole Montminy or Matthew Bailey.